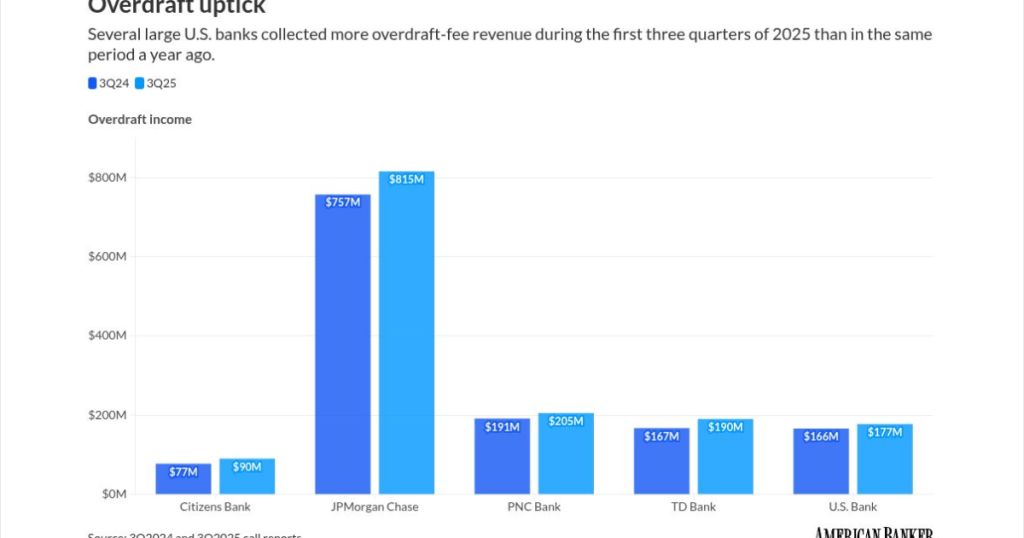

- Key insight: Certain large U.S. banks reported an uptick in overdraft-related revenue during the first three quarters of 2025.

- What’s at stake: Though the increases coincide with the Trump administration’s defanging of the Consumer Financial Protection Bureau, some of the banks say the uptick is a result of more consumers using overdraft services.

- Forward look: While large banks’ overdraft-fee revenue is generally much lower than it was a few years ago, some consumer advocates worry that banks will find opportunities in the current deregulatory environment to alter their overdraft practices.

Several of the largest U.S. banks reported an increase in overdraft-related revenue for the first three quarters of 2025, though some of them say they haven’t altered their overdraft policies.

Processing Content

The upticks at

The revenue increases coincide with

Some banks attribute the uptick in overdraft fee revenue to changing consumer behavior. Inflation and other economic headaches are resulting in higher usage of overdraft services, they say. These banks also contend that the uptick in overdraft fee revenue is a result of banks opening more customer accounts.

Both banks said they haven’t made any changes to their overdraft policies in the past year.

“Chase has spent more than a decade improving its overdraft services — eliminating fees and making it easier for customers to avoid charges,” a

To be sure, the total amount of overdraft-related income that banks are collecting is far below the amount they were raking in prior to the widespread overdraft reforms of 2022. Along with lowering overdraft fees, most of the top 20 largest banks

The exact cause of the increase in overdraft-related revenue between Jan. 1, 2025, and Sept. 30, 2025, is “not 100% obvious,” Jennifer Tescher, the founder and CEO of the Financial Health Network, told American Banker. “There haven’t been a bunch of announcements from banks and credit unions increasing overdraft fees or making changes to [overdraft] policies.”

But with inflationary pressure and affordability challenges, “it would not be surprising if consumers were actually using more overdraft services at this moment,” Tescher said.

Overdraft charges have been a sore spot for the industry for years. Following years in which the fees generated substantial noninterest income for banks, the Biden administration pushed hard for reform, arguing that banks were charging such fees in an unfair or deceptive manner.

Amid the pressure from regulators, a few banks —

In late 2024, the Biden administration’s reform push culminated in a CFPB rule that would have forced the largest banks to

Banks

Some consumer advocates worry that the repeal of the rule and the dismantling of the CFPB are creating opportunities for banks to alter their overdraft policies. Christine Hines, a senior policy director at the National Association of Consumer Advocates, said that without the CFPB acting as a watchdog, banks “can go back to doing what they do without supervision.”

The higher prices of goods and services are also likely playing a role in the increase in overdraft fee revenue, Hines noted.

“I think it also really gets to the point that if people are struggling, the overdraft rule would have benefited them a great deal,” she said.

While overdraft-related revenue rose at those two banks, it remains far lower at both

Both banks have added certain features to help clients avoid fees. At

Another bank where overdraft fee revenue rose during the first nine months of 2025 is TD Bank. The U.S. arm of Toronto-based TD collected $190 million in overdraft fees during the nine-month period, about 13.8% more than it collected during the same months in 2024, according to its call report.

TD has a troubled overdraft history, including a class-action lawsuit tied to overdraft, which it later settled, and

Like many of its peers, TD in recent years introduced a low-cost deposit account with no overdraft fees. It also eliminated overdrafts of $50 or less and now offers a next-day grace period that allows customers extra time to make their accounts positive before incurring a fee.

The bank declined to say if it has made any changes to its overdraft policies in the past year.

At U.S. Bank in Minneapolis, overdraft-related income totaled $177.7 million for the first, second and third quarters of 2025. That was up about 6.6% compared with the same period the prior year.

The super-regional bank has made no changes to overdraft fees in the past 12 months, a company spokesperson said in an email. The increase reflects “more overdraft occurrences and additional clients versus a year ago,” the spokesperson said.

The bank declined to elaborate on the increase in overdraft occurrences and additional clients.

PNC Bank in Pittsburgh reported a 7.6% increase in overdraft revenue between Jan. 1, 2025, and Sept. 30, 2025. The bank did not respond to a request for comment.

Certain other large banks reported decreases in overdraft income. Capital One’s overdraft-fee revenue, which totaled $57.9 million for the first nine months of 2021, was just $123,000 as of Sept. 30, 2025, following its decision to eliminate the fees .

Truist Financial in Charlotte, North Carolina, which now

Bank of America, which