Property is one of Australia’s favourite investment vehicles, and no wonder. Previous Your Mortgage analysis found house prices rose by more than 1,400% over the 44 years to October 2024.

Property values have been influenced by a variety of factors in recent times, including rising and falling interest rates, supply shortages, and shifting buyer demand. Experts suggest price growth may have peaked, with expectations of a more gradual increase moving forward.

So, where does that leave house prices across Australia right now? Keep scrolling as we dive into the latest dwelling value data, courtesy of Cotality (formerly CoreLogic).

What’s Australia’s median house price in January 2026?

As of the end of December 2025, the median house price in Australia stands at $980,343, according to Cotality data.

However, house prices can vary significantly depending on location, particularly between major cities and regional areas. Across the eight state and territory capital cities, the median house price currently sits at $1,126,860, with Sydney leading the market and Darwin having the most affordable prices among the capitals.

In contrast, the combined median house price for regional areas across the country is $749,692, reflecting more affordable options outside of major metropolitan hubs.

What’s Australia’s median unit price in January 2026?

As the end of November 2025, the median price of a unit, apartment, or townhouse across Australia stood at $728,184, according to Cotality data.

The composition of unit markets varies across the country, with higher concentrations typically found in major cities where population density is greater. Consequently, unit prices tend to be higher in urban areas compared to regional locations.

Currently, the median unit price in capital cities is $744,295 while in regional areas, it sits at $646,570.

Units remain an attractive option for both investors and first home buyers due to their relative affordability compared to houses, with demand particularly strong in metropolitan markets.

Low-rate home loan deals

In the market for your first or next home or investment? Make sure you get the best home loan deal available to you! Check out some of the market’s most competitive home loans below:

| Lender | Home Loan | Interest Rate |

Comparison Rate* |

Monthly Repayment |

Repayment type |

Rate Type |

Offset |

Redraw |

Ongoing Fees |

Upfront Fees |

Max LVR |

Lump Sum Repayment |

Extra Repayments |

Split Loan Option |

Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

5.29% p.a. |

5.33% p.a. |

$2,773 |

Principal & Interest |

Variable |

$0 |

$530 |

90% |

|

Promoted |

Disclosure | ||||||||||

|

5.19% p.a. |

5.10% p.a. |

$2,742 |

Principal & Interest |

Variable |

$0 |

$0 |

80% |

|

|

Disclosure | ||||||||||

|

5.39% p.a. |

5.43% p.a. |

$2,805 |

Principal & Interest |

Variable |

$0 |

$530 |

90% |

|

Promoted |

Disclosure |

Important Information and Comparison Rate Warning

Median house prices in Sydney

Greater Sydney’s property market remains one of the most expensive in Australia, with a median house price of $1,587,709 and a median unit price of $901,314. Combined, the city’s median dwelling price sits at $1,280,613.

While this reflects a 0.1% decrease compared to December 2025, Sydney property values have seen a 36.2% increase over the past five years.

Among the suburbs experiencing the fastest price growth in the past 12 months are Merrylands-Guildford (+12.5%), St Marys (+12.5%), and Richmond-Windsor (+11.6%).

Median house prices in Melbourne

In recent times, Greater Melbourne’s property market has underperformed those of many other Australian capital cities, currently boasting a median house price of $981,165 and a median unit price of $640,391. Combined, the city’s median dwelling price sits at $827,117.

While this reflects a 0.1% decrease compared to Deccember 2025, Melbourne property values have increased by 15.5% over the past five years, considerably less than other capital cities.

Among the suburbs experiencing the fastest price growth in the past 12 months are Frankston (+14.3%), Brimbank (+9.5%), and Kingston (+9.4%).

Median house prices in Brisbane

Greater Brisbane’s property market continues to grow steadily, with a median house price of $1,131,329 and a median unit price of $807,161. Combined, the city’s median dwelling price sits at $1,036,323.

This represents a 1.6% increase compared to December 2025, with Brisbane property values rising by 86.7% over the past five years.

Among the suburbs experiencing the fastest price growth in the past 12 months are Springwood-Kingston (+19.5%), Sunnybank (+19.4%), and Nathan (+18%).

Median house prices in Adelaide

Greater Adelaide’s property market remains strong, with a median house price of $960,501 and a median unit price of $660,644. Combined, the city’s median dwelling price sits at $902,249.

This reflects a 1.9% increase compared to December 2025, with Adelaide property values surging by 79.8% over the past five years.

Among the suburbs experiencing the fastest price growth in the past 12 months are Adelaide Hills (+12.2%), Salisbury (10.6%), and Gawler – Two Wells (+10.5%).

Median house prices in Perth

Greater Perth’s property market continues to grow, albeit a little slower than it was previously, with a median house price of $983,068 and a median unit price of $677,722. Combined, the city’s median dwelling price sits at $940,635.

This represents a 1.9% increase compared to December 2025, with Perth property values rising by 89% over the past five years.

Among the suburbs experiencing the fastest price growth in the past 12 months are Belmont – Victoria Park (+20%), Armadale (+19.5%), and Serpentine – Jarrahdale (+18.9%).

Median house prices in Hobart

Hobart’s property market has softened, with a median house price of $768,376 and a median unit price of $566,069. Combined, the city’s median dwelling price sits at $720,341.

This reflects a 0.9% increase compared to December 2025, with Hobart property values rising by 30.5% over the past five years.

Among the suburbs experiencing the fastest price growth in the past 12 months are Hobart – North West (+10.7%), Hobart – North East (+7.8%), and Hobart – South and West (+6.1%).

Median house prices in Canberra

The ACT capital’s property market has remained relatively stable of late, with the territory commanding a median house price of $1,040,948 and a median unit price of $592,370. Combined, its median dwelling price sits at $893,907.

This reflects a 0.2% increase compared to December 2025, with Canberra property values rising by 27.9% over the past five years.

Among the ACT suburbs experiencing the fastest price growth in the past 12 months are Tuggeranong (+6.9%), Molonglo (+6.1%), and Belconnen (+5.8%).

Median house prices in Darwin

Greater Darwin’s property market remains relatively affordable, with a median house price of $697,251 and a median unit price of $433,232. Combined, the city’s median dwelling price sits at $586,912.

This reflects a 1.6% increase compared to December 2025, with Darwin property values rising 38.3% over the past five years.

Among the areas experiencing the fastest price growth in the past 12 months are Palmerston (+26.3%), Darwin Suburbs (+18.1%), and Darwin City (+14.5%).

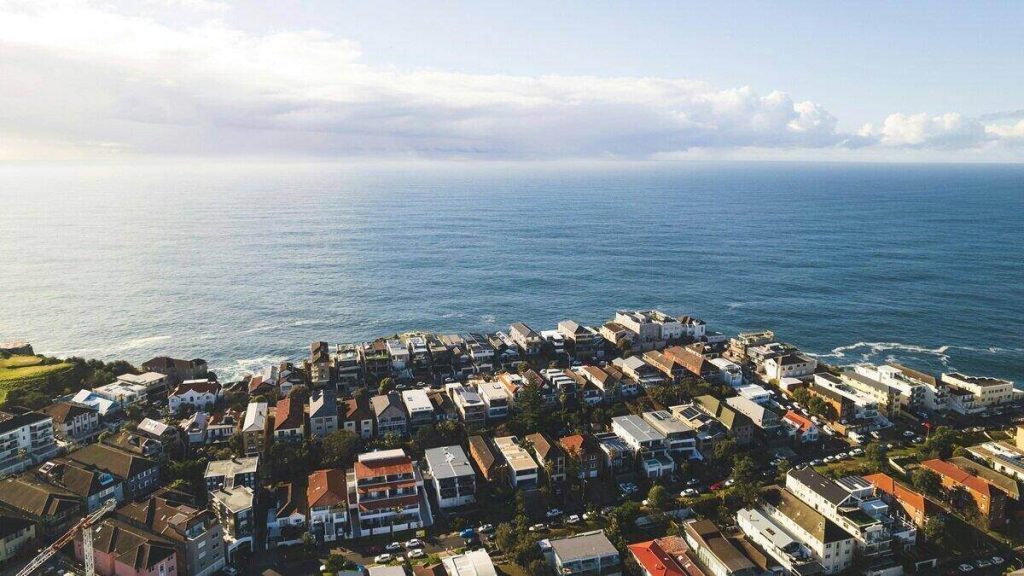

Image by Martin David on Unsplash

First published in November 2025