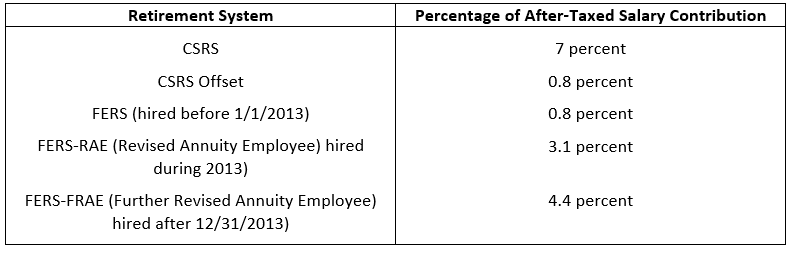

Both CSRS/CSRS Offset and FERS employees contribute to their respective retirement systems via payroll deduction. Each pay date, a portion of the employee’s after-tax salary is contributed to either the CSRS Retirement and Disability Fund or the Federal Employees Retirement and Disability Fund. The following table summarizes what percentage of the employee’s after-tax salary is contributed:

Employee Contributions to the CSRS or the FERS Retirement and Disability Fund

After they retire from federal service and start receiving their CSRS annuity and FERS annuity, CSRS/CSRS Offset and FERS employees will receive as part of the monthly annuity the contributions they made to their respective retirement system. Because the contributions were made with after-tax salary, the total contributions made represent the retired employee’s cost basis in his or her CSRS or FERS retirement and therefore when distributed to them, they will not be taxed again.

CSRS / FERS Annuity Statements

Shortly after retiring from federal service, a retired employee will receive from the Office of Personnel Management (OPM) a booklet that provides information to the employee related to their retirement. The informational items included are an annuity statement, starting gross monthly annuity rate, and the annuitant’s cost in his or her CSRS or FERS retirement:

• Annuity statement. The statement that a recently retired federal employee receives from the OPM Retirement Office shows the annuity starting date, the gross monthly rate of the annuity benefit, and the recently retired employee’s CSRS or FERS total contributions to the CSRS or FERS Retirement and Disability Funds, respectively. Since these contributions (see table above) were made with after-taxed dollars, these contributions represent the retired employee’s cost basis in his or her retirement. The total contributions are reported to the retired employee and will be recovered by the retiree tax-free over the retiree’s life expectancy.

• Gross monthly rate. This is the starting gross monthly annuity amount that a recently retired employee will receive after any adjustment for electing a survivor’s annuity and, for CSRS/ CSRS Offset retirees only, an adjustment for not paying back any redeposits of withdrawn CSRS contributions (including interest) that were made before March 1, 1991.

• Annuitant’s cost in the CSRS or FERS retirement. A portion of a CSRS or a FERS retiree’s monthly annuity payment contains an amount in which the retiree’s previously paid income tax. This amount represents the retiree’s contributions to the CSRS or FERS retirement plan (see table above). Even though the retiree did not receive the money that was contributed to the CSRS or FERS Retirement and Disability Fund, the contribution was included in the then employee’s taxable income for federal and state tax purposes in the years it was taken out of the employee’s pay.

Included in the employees’ cost in the retirement are deposits (including interest) for military service and temporary (non-deduction) service. Also included in the annuitant’s cost are redeposits in which employees repaid contributions that the employee had withdrawn from the CSRS or FERS retirement plans when they left federal service .

Recovering an Annuitant’s Cost in the Retirement Tax-Free

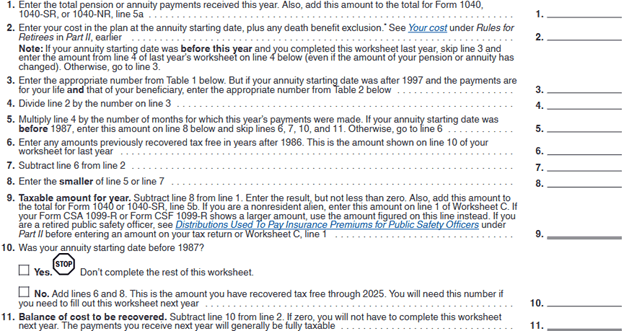

Any employee who retires after November 18, 1996 and whose annuity’s starting date is November 19, 1996 or later, must use the IRS Simplified Method to calculate the tax-free portion of their CSRS or FERS annuity. The following is a copy of the Simplified Method (available in IRS Publication 721 (Tax Guide to U.S. Civil Service Retirement Benefits – Worksheet A) for calculating the taxable amount of the CSRS or FERS annuity payments.

Worksheet A. Simplified Method

Note the following from the Simplified Method Worksheet A:

• Line 1. Total pension or annuity payments received this year. This line is the CSRS or FERS annuitant’s gross annuity payments received during the year. These payments are reported to a CSRS or FERS annuitant each January on their CSA 1099-R. The CSA 1099-R shows the amount of an annuitant’s gross CSRS or FERS annuity that the annuitant received in the previous year, shown in the box entitled “Gross Distribution”.

• Line 2. investment in the contract (cost basis) at the annuity starting date. This line represents the CSRS or FERS annuitant’s “cost” in his or her retirement, as explained above under ”annuitant’s cost.” Note that OPM’s retirement office reports that amount to a CSRS or FERS annuitant each January on their CSA 1099-R in a box entitled Original Contributions.

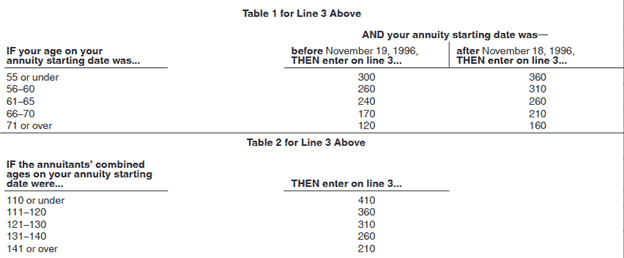

• Line 3. An annuitant must choose a life expectancy factor that depends on the following: (1) The annuity starting date, before November 19,1996 or after November 18, 1996; (2) Whether the annuitant is giving a survivor annuity to one person. If the annuitant is giving a survivor annuity to one person, the total of the combined ages of the annuitant and survivor annuitant in the month/year the annuitant receives his or her first CSRS or FES annuity check; and (3) The age of the annuitant in the year he or she will receive his or her first CSRS or FERS annuity check.

The following example illustrates the Simplified Rule for calculating the taxable portion of a FERS annuity.

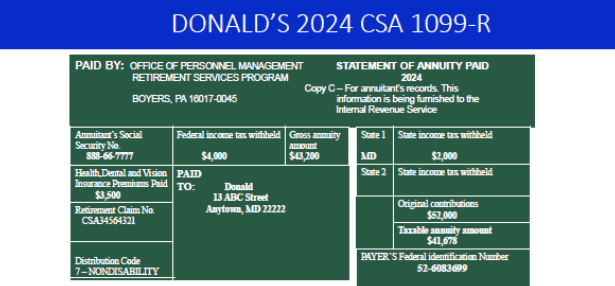

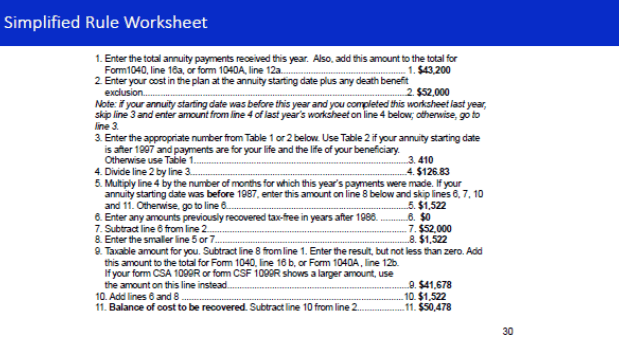

Donald, a FERS-covered employee, retired from federal service on November 30,2023 under a FERS annuity that provides a full 50 percent survivor benefit to his wife, Kathy. Donald’s first annuity check was dated January 1, 2024. Donald ‘s 2024 CSA 1099-R is shown below. Donald uses the Simplified Rule to determine the tax-free portion of his FERS annuity that he received during 2024.

Donald’s monthly FERS gross annuity during 2024 is $3,600 for a total of 12 months times $3,600 per month or $43,200 during all of 2024. Donald has contributed a total of $52,000 of his after-taxed salary to the FERS Retirement and Disability Fund while in federal service. During 2024, Donald was 56 years old, and Kathy was 54 years old when Donald received his first FERS annuity check.

Donald’s complete worksheet is shown below. To complete line 3 of the worksheet Donald used Table 2 and found the number in the second column opposite the age range that includes 110 (his age during 2025 of 56 plus Kathy’s age of 54 during 2024 which equals 110). Donald keeps a copy of the complete worksheet for his records. It will help him and Kathy to determine the taxable amount of the survivor annuity in the event Donald predeceases Kathy.

Note the following from Donald’s Simplified Rule worksheet:

1. The taxable portion of Donald’s FERS annuity for the year 2024 is $41,678, as shown on line 9 and in the box entitled “Taxable annuity amount” on Donald’s CSA 1099-R

2. The difference between the gross annuity ($43,200) (see the box entitled “Gross annuity amount” on Donald’s CSA 1099-R) and the “Taxable annuity amount” ($41,678) or $1,522 represents the amount that Donald is receiving each year that is a return of his $52,000 that he contributed on an after-tax basis via payroll deduction to the FERS Retirement and Disability Fund while he was in federal service.

3. The $1,522 – the annual return of Donald’s FERS contributions – does not change from one year to the next, even when the FERS annuity is receiving cost-of-living adjustments (COLAs).

4. The $52,000 total contribution that Donald made to the FERS Retirement and Disability Fund will be recovered by Donald over a period of 410 months (see line 3 of the worksheet). Dividing $52,000 by 410 is $126.83 (line 4 of the worksheet) which means that Donald will recover $126.83 of his $52,000 contribution each month. If he lives and receives 410 FERS annuity payments he would recover his entire cost in his retirement. But if he dies before that 410 month, then the same $126.83 “recovery of cost”, will be deducted from Kathy’s 50 percent survivor annuity until it is recovered in full.