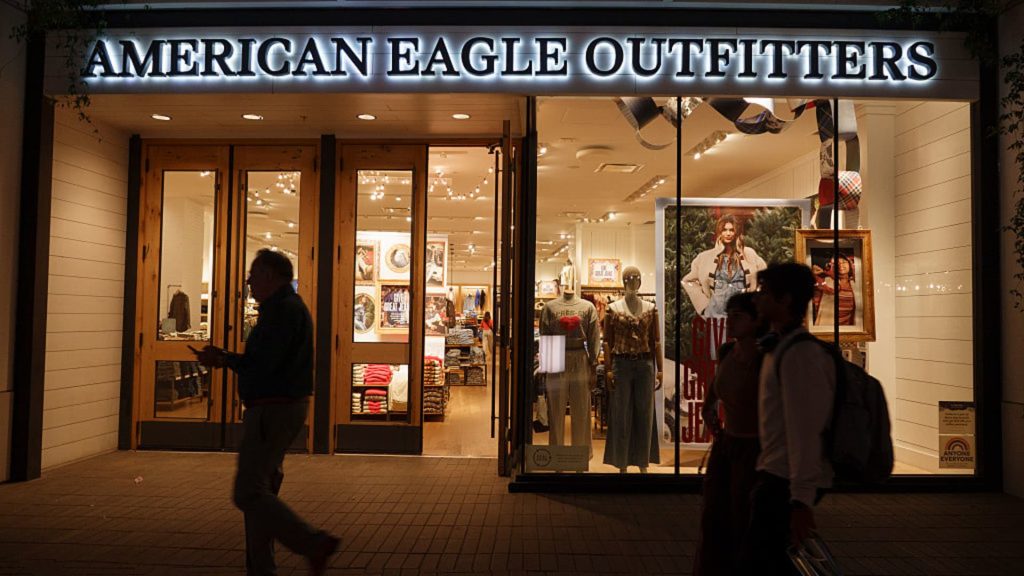

Check out the companies making headlines before the bell. American Eagle Outfitters — Shares jumped nearly 13% after the retailer reported third-quarter earnings of 53 cents per share on revenue of $1.36 billion, beating the Street’s expected earnings of 44 cents per share on revenue of $1.32 billion, according to LSEG data. Strong sales in the company’s Aerie division contributed to the better-than-expected results. Marvell Technology — The stock popped 9% after the provider of data infrastructure semiconductor solutions posted third-quarter earnings of 76 cents per share excluding one-time items on revenue of $2.08 billion, topping analysts’ consensus estimate of 73 cents per share on revenue of $2.07 billion, LSEG data shows. Acadia Healthcare — The behavioral health care and residential treatment provider dropped more than 24% after it cut its full-year earnings guidance. The company now sees earnings per share in a range of $1.94 to $2.04. down from a prior outlook of $2.35 to $2.45. Acadia also updated its liability reserves. Okta — An earnings beat boosted Okta shares by 4%. The company reported third-quarter earnings of 82 cents per share excluding one-time items on revenue of $742 million versus analysts’ expected earnings of 76 cents per share on revenue of $730 million, according to LSEG data. Sprinklr — The customer experience software company rose 4% on better-than-expected results for the third quarter. Sprinklr earned an adjusted 12 cents per share on revenue of $219.1 million. Analysts expected a profit of 9 cents per share on revenue of $209.6 million. Fourth-quarter and full-year guidance also beat expectations. Microchip Technology — The semiconductor manufacturer gained 3.5% after raising guidance for the third quarter. Microchip Technology now expects adjusted earnings of 40 cents per share, versus previous guidance of 34 cents to 40 cents a share. It also projects revenue at the high end of its previously guided range of $1.109 billion to $1.149 billion. Asana — After reporting third-quarter earnings of seven cents per share excluding one-time items on revenue of $201 million, the company’s stock popped nearly 3%. Analysts had expected earnings of six cents per share on revenues of $199 million, LSEG data shows. Asana also raised the high-end of its full-year revenue outlook for 2026. Macy’s — Shares were down slightly premarket even after the company posted a surprise profit for the third quarter. The department store chain earned an adjusted 9 cents per share, while analysts polled by LSEG expected a loss of 14 cents per share. Revenue of $4.71 billion also beat a consensus forecast of $4.62 billion. CrowdStrike — Despite the cybersecurity firm reporting better-than-expected earnings of 96 cents per share excluding one-time items on revenue of $1.23 billion for the third quarter, shares fell about 1.4%. The Street was expecting earnings of 84 cents per share on revenue of $1.22 billion, per LSEG data. Box — Although Box beat on revenue, shares fell about 5%. The company reported revenue of $301 million, topping the Street’s estimate of $299 million, according to LSEG. However, it posted third-quarter earnings of 31 cents per share, in line with analysts’ expectations. GitLab — The stock fell 9% after posting third quarter-earnings of 25 cents per share excluding some items on revenue of $244 million that fell short of analysts’ consensus estimates of 20 cents earnings per share on revenue of $238 million. Pure Storage — Shares fell 13% after the data management and storage firm reported third quarter earnings of 58 cents per share ex-items on revenue of $964.5 million. Analysts had expected EPS of 58 cents on revenue of $956 million, LSEG data shows. — CNBC’s Michelle Fox-Theobald and Fred Imbert contributed reporting

AEO, OKTA, MCHP and more

About Us

Our finance blog is your go-to resource for expert financial advice, covering everything from personal budgeting and saving strategies to smart investing and market analysis. Stay updated with the latest trends, tips, and insights to help you make informed decisions and achieve financial success.

Subscribe to Updates

Subscribe to Get the Latest Financial Tips and Insights Delivered to Your Inbox!

© 2026 Budgetsmart.ai – All rights reserved.