A year ago, I looked at the dividend safety of natural gas shipper Flex LNG (NYSE: FLNG). At the time, it had a whopping 13% yield. However, falling free cash flow and a payout ratio that exceeded 100% meant the stock received an “F” rating.

Fortunately for shareholders, the quarterly dividend has remained intact at $0.75 per share, giving the stock a current yield of more than 11%.

But can that $0.75 dividend stay afloat?

When I reviewed the stock last year, one problem was that free cash flow was projected to fall to $152 million in 2025 from $183 million the previous year. The actual numbers in 2025 were even worse than expected.

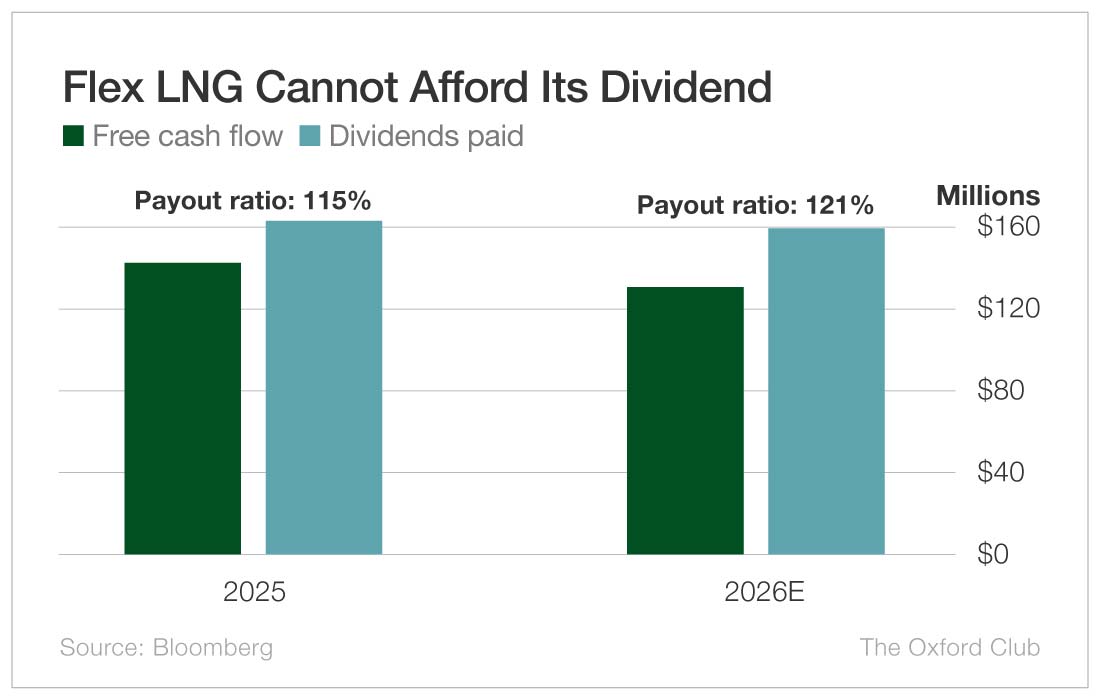

Flex LNG generated just $141 million in free cash flow in 2025 while paying out $162 million in dividends. That came out to a payout ratio of 115%. In other words, for every $1 of free cash flow it made, the company paid out $1.15.

Think of it like this: If you make $100,000 a year and spend $115,000, that extra $15,000 has to come from somewhere. You either have to take it out of savings or borrow it.

The same thing goes for companies. When a company’s amount paid in dividends exceeds its free cash flow by that much, it’s a big concern.

This year, free cash flow is forecast to drop further to $131 million. Flex LNG is projected to pay shareholders $159 million in dividends, increasing the payout ratio even more to 121%.

Falling free cash flow and a too-high payout ratio mean the dividend is even less safe than it was a year ago.

Flex LNG shareholders should not be surprised if the dividend is reduced in the next year.

Dividend Safety Rating: F

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.