![]()

![]()

Annie

13th Oct 2025

Reading Time: 5 minutes

From free coupon apps with AI to find instant discounts on your shopping, to cashback sites and even robo-investing apps, there are several ways you can make the most of easy-to-use apps and save more money than ever this year.

Why Use Money Saving Apps?

Apps can save you so much time when looking for bargains. But they can also protect you, too. In an age when it seems like we’re hearing about a major hacking scandal every other week, apps can help you find legitimate automatic coupons and website discounts without risking your security on questionable discount websites.

They also save you the mental stress of remembering to save money, thanks to the automatic nature of them. Whether you’re using a browser extension that reminds you to search for a discount at checkout, or an auto-roundup app to sweep cash into a savings pot with each transaction, the mental load of saving money is taken off you.

We’ve rounded up the best free coupon apps, cashback sites, and saving apps to help you manage your money in just a few clicks.

Coupert

Coupert helps you find instant discount codes and coupons to save money on your everyday spending. It price matches, finds discounts in seconds, and keeps you on the site you’re browsing instead of making you open a new tab to find a coupon code.

AI apps can handle so much more than ever before. For example, Coupert finds you discounts in real time, but not just a list of them: it tests if they’ll work. Within seconds, you can find automatic coupons to claim your discounts. It saves you so much time and also stops that really annoying task of finding a coupon code on dodgy-looking sites that seem to open lots of pop-ups and browser tabs.

That’s because Coupert uses a browser extension, so it’s always ready to step in when you’re shopping and works in-site.

Editor Vicky Parry says: “While I love the other apps in this list, Coupert takes top place because it saves you so much time on finding coupon codes, but it can also price track to help you buy when a product is at a low price as well as find an automatic coupon for even more discounts.”

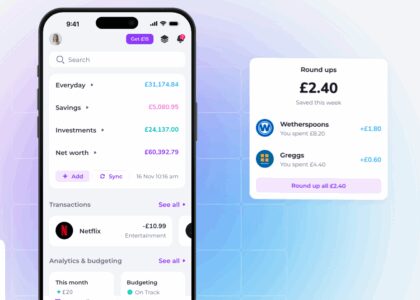

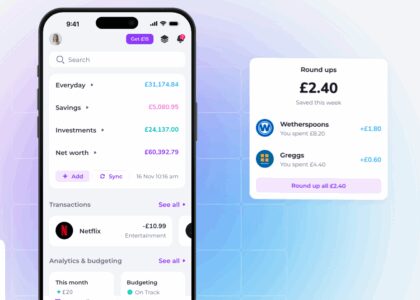

Plum: The Auto-Save App

Saving is much easier when you don’t have to think about it. Plum analyses your income and expenses, and works out how much you can set aside into a savings pot every few days.

This might be pennies or it could be several pounds – and it’s easy to cancel if you’re having a tight month. However, sweeping cash across like this makes it so simple to save without noticing.

Plum also offers interest up to 3.95% AER on savings, and you can set an auto-roundup from your spending, too. This is when you choose to round up your payments to the nearest pound. So, if you spend £4.50 in a transaction, you will be charged £5 as the spare 50p sweeps into your savings pot. It’s honestly mindless saving that can make a big difference quite quickly if you’re not in any kind of savings habit at all these days.

TopCashback

Celebrating its 20th anniversary this year, Topcashback has been around a while and that means it offers cashback on loads of mainstream and smaller retailers, with a tried-and-tested reputation. It’s one of the most recognisable cashback apps out there.

It does have a browser extension for cashback, but it can be a little finicky and sometimes requires several page refreshes if you’re taking your time to browse to reactivate the cashback. Despite this, it does search for cashback deals offered by the site in case you’ve forgotten to go via the TopCashback website.

It’s worth mentioning that other free coupon apps like Coupert also offer cashback, and payouts are likely to be faster with the all-in-one AI tools than TopCashback.

Emma App

The Emma app is perfect for a deep-dive analysis of your spending and income, as it integrates with your bank accounts. This means it will help you spot your spending habits that could be curbed to save money with ease.

It helps you spot things like forgotten subscriptions, while also keeping track of your savings goals to help you stay focused. While it doesn’t offer shopping discounts and cashback like Coupert and TopCashback, identifying your regular spending and making it easier to cancel unwanted expenses will help build on your savings power.

The Emma app also helps you build your credit score, using your rent to prove you are a reliable person who could pay for a mortgage. This could make a huge difference to first-time buyers who need to boost their credit score before they apply for a mortgage.

TOTUM

TOTUM is the latest incarnation of the student discount card. But here’s the thing: it’s no longer just for students. They recently expanded their offering to a huge number of people: anybody belonging to a professional body, union, or trade membership organisation can have a TOTUM card.

While many of the discounts are aimed at students and young people, such as the inclusion of the ISIC, the international student card, it’s still fantastic for any professional wanting to save money on their spending.

The TOTUM app doesn’t offer automatic coupons like Coupert but it does make it easy to claim discounts in store. Online, you can nab some exclusive deals such as cashback on Apple, Windows, Argos, and even travel such as Trainline. And because it’s the nationally-recognised discount card, loads of local retailers will accept it even if they’re not listed on the website directory – just ask at the checkout. It also includes extra deals such as a free Tastecard membership to save on meals out.