Recently, we’ve received several Safety Net requests that all fall under the same field: finance. Those names are T. Rowe Price (Nasdaq: TROW), Western Union (NYSE: WU), and Peoples Bancorp (Nasdaq: PEBO).

So, while Chief Income Strategist Marc Lichtenfeld is out this week, I thought it would be fun to shake things up a bit and review all three of these stocks at one time – pitting them against one another to find the ultimate champion.

Let’s start by looking at T. Rowe Price, an investment management firm similar to Vanguard or Fidelity. A huge amount of the company’s income comes from investment advisory fees, and revenue has seen a steady increase in the past year. At current prices, the stock yields 4.8%.

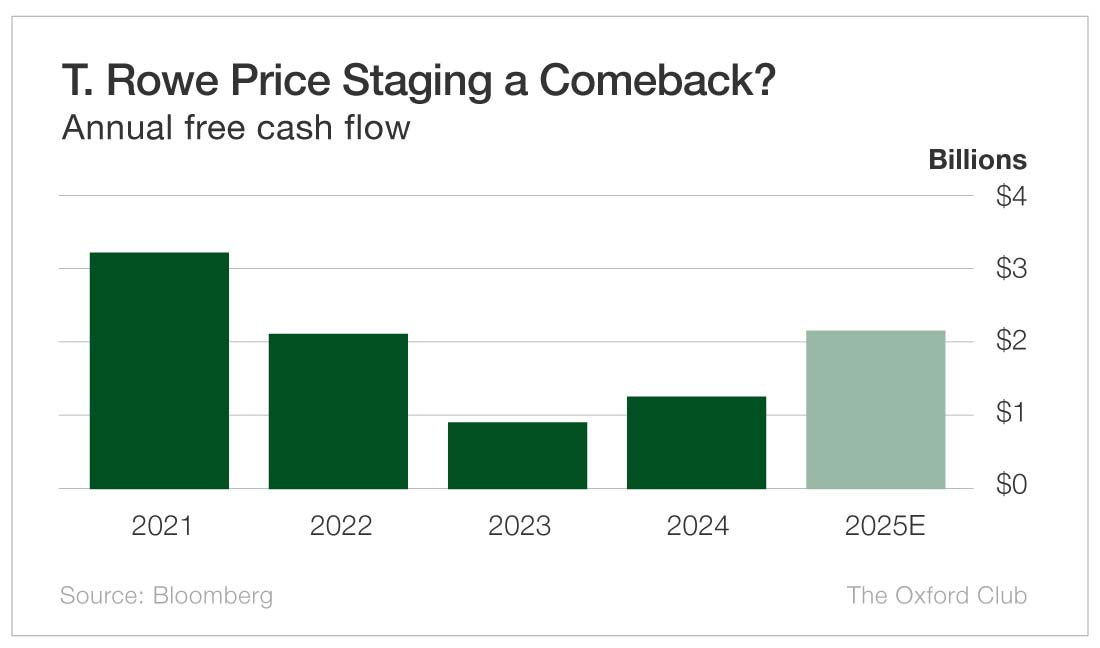

Free cash flow took a massive hit in both 2022 and 2023. However, 2024 saw a bounce back with a 38.5% gain, and free cash flow is projected to nearly double this year.

A major downside is that T. Rowe Price’s dividend payout ratio currently sits at 90%, which is above our threshold of 75%. The good news is that the company has increased its dividend every year for the last decade, earning it some brownie points.

Next, let’s talk about Western Union. This company specializes in money transfer, allowing its customers to securely send money to people or businesses across borders. The company covers the areas that banks can’t by acting as a liaison for those that don’t have a bank account or who need cash immediately. (A bank wire transfer can take one to three days.)

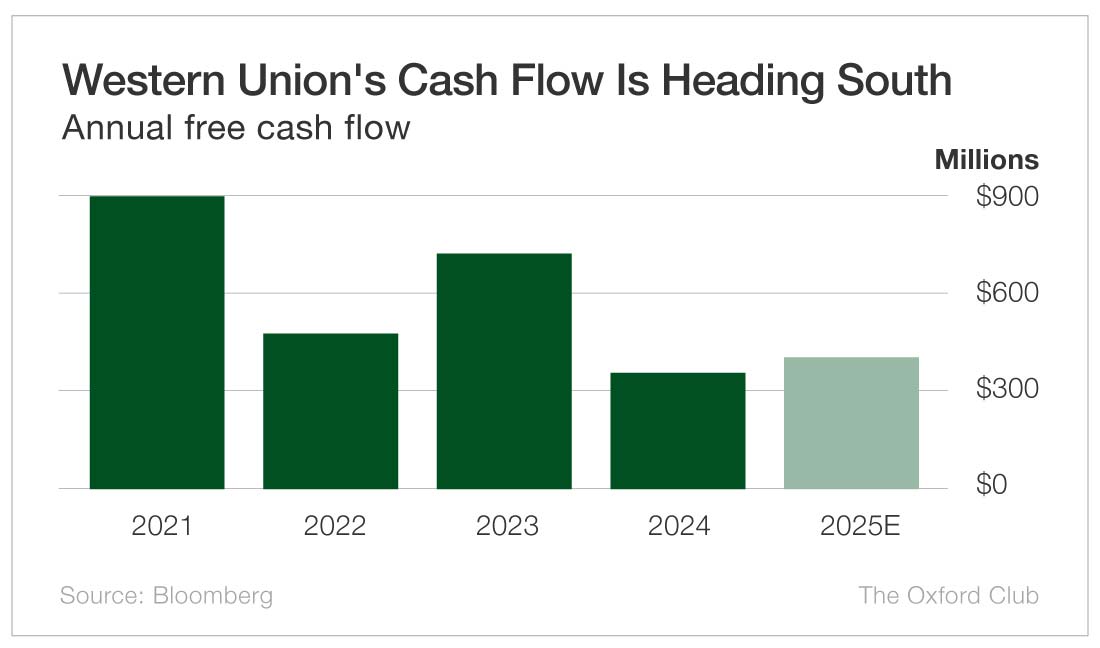

Turning to the safety of its dividend, we see a couple of red flags that could jeopardize its attractive 11.2% yield.

First off, Western Union’s free cash flow has been all over the place. It peaked in 2021 at $900 million but has been bouncing around ever since. Free cash flow in 2024 was down 50% from the previous year and down 60% from three years prior.

On top of that, Western Union announced in August that it will be acquiring International Money Express (Nasdaq: IMXI), which will result in a major hit to the company’s free cash flow.

The company’s dividend payout ratio, just like T. Rowe Price’s, is sitting above our 75% threshold at 90%.

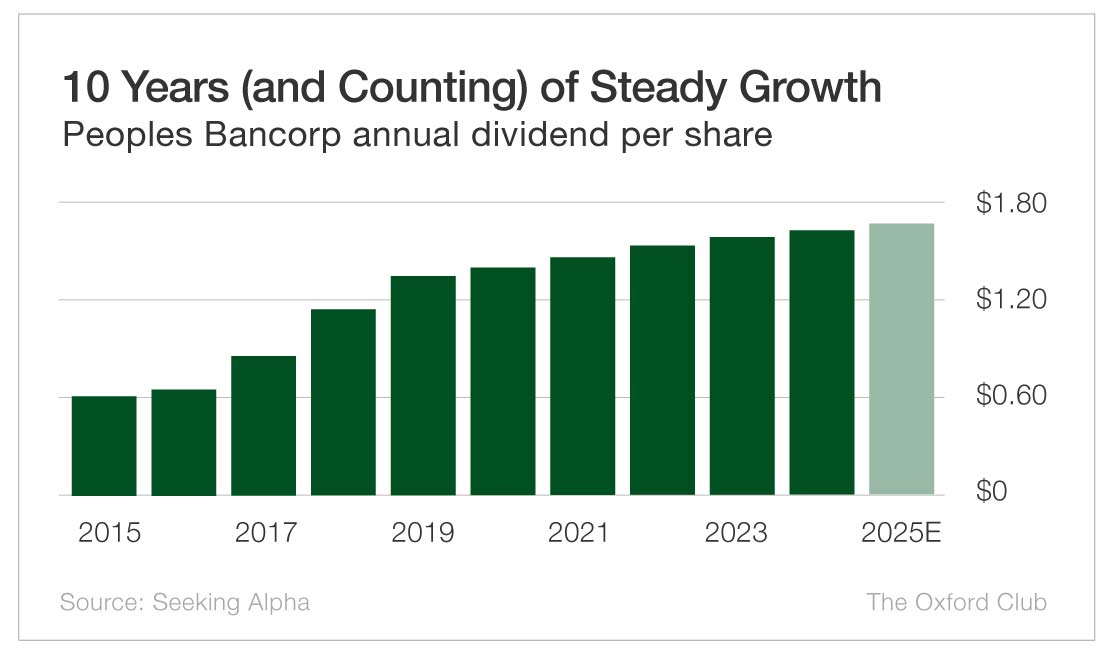

Finally, let’s look at Peoples Bancorp, a company that provides banking services from Ohio to Maryland. The stock yields a solid 5.5%.

The company’s biggest revenue source is net interest income, or NII – the difference between the money it earns from loans and investments and the interest expense it pays on deposits. We will be using that metric to measure free cash flow.

NII is up both on the year and over the last three years. The forward-looking estimates predict an even larger increase this year.

The company’s payout ratio currently sits at 16%, well below our 75% threshold. Its balance sheet looks stellar as well.

On top of all of that, Peoples Bancorp has increased its dividend every year for the past 10 years.

Now, it’s time to reveal the results of our first-ever Clash of the Finance Titans (it’s a working title).

In third place, we have Western Union with a grade of “F.”

Based on our scoring system, the company’s dividend has a high risk of being cut. I’m concerned about its inconsistent cash flow and high payout ratio.

In second, we have T. Rowe Price with a “C.”

There’s some risk here, but the company’s cash flow growth projections and strong dividend track record should help.

And in first place, we have Peoples Bancorp with a mighty “A.”

This is one of the safest dividends I’ve ever seen. I’d even go as far as to say that you’re more likely to see a dividend raise than a dividend cut.

Western Union Dividend Safety Rating: F

T. Rowe Price Dividend Safety Rating: C

Peoples Bancorp Dividend Safety Rating: A

If you enjoyed this format, let us know by either commenting below or sending us an email here.

And, as always, feel free to send us more companies whose dividends you’d like us to review.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.