Nearly a year and a half ago, OneMain Holdings (NYSE: OMF) yielded 8%.

My only concern at the time was that net interest income, or NII, was expected to drop to $3.3 billion. That still would’ve been enough to pay the dividend, but it could have signaled the beginning of a negative trend. (Net interest income is how we measure financial companies’ ability to pay their dividends.)

Today, because the stock price has risen since then, OneMain yields 7.3%.

The company, also called OneMain Financial, is a subprime lender, offering credit cards, personal loans, auto loans, and other credit products. It has been operating for 113 years and has expanded to 47 states from 44 last year.

As for the company’s results, analysts – as they often do – got it wrong. Instead of reporting $3.3 billion in net interest income, OneMain generated $3.8 billion in NII in 2024.

It paid out $498 million in dividends for an ultra-low payout ratio of 13%.

This year, NII is forecast to rise to $3.9 billion, while the payout ratio is projected to decline to an even lower 11%.

I like to see payout ratios below 75% so I can be confident in the company’s ability to afford its dividend if it has a rough year or two. A payout ratio barely above 10% means OneMain has plenty of cash to pay the dividend even if NII were to take a massive hit.

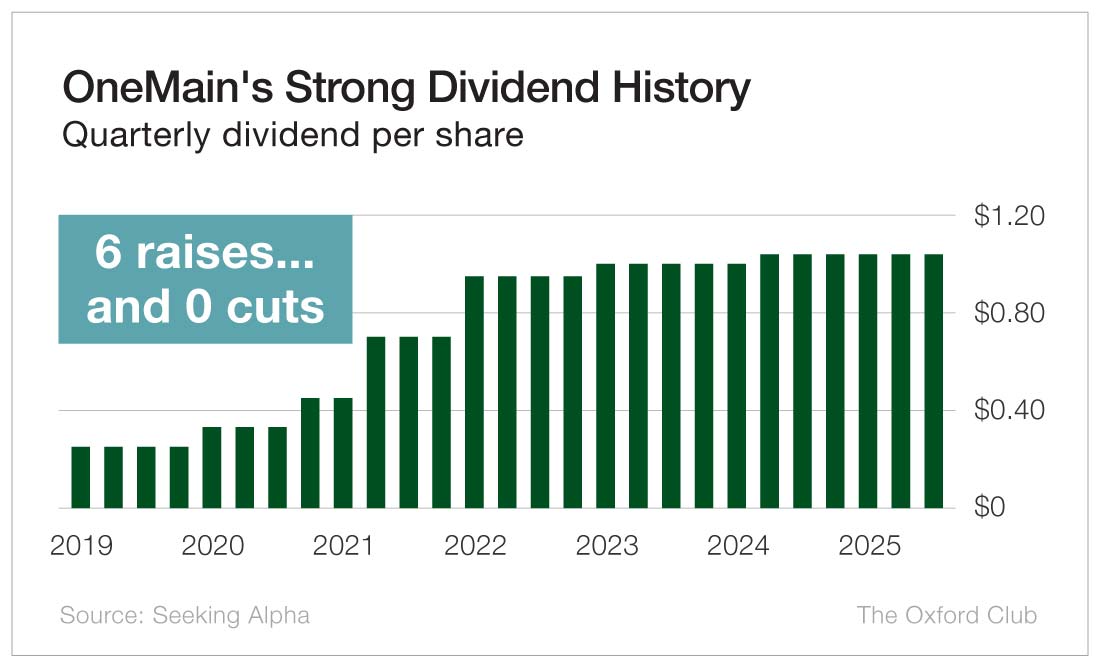

The company began paying a quarterly dividend in 2019. The payout has risen every year by an impressive compound annual growth rate of 27%, though the increases have become considerably smaller in recent years.

The boost last year was 4%. OneMain has not raised the dividend since the second quarter of 2024, but it has also never cut the dividend. It occasionally pays a special dividend, though it hasn’t done so since 2021.

There are no concerns about OneMain Holdings’ ability to pay its dividend and no blemishes on its dividend-paying track record.

This 7.3% yielder’s dividend is safe.

Dividend Safety Rating: A

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.