I was looking at ICE’s most recent Mortgage Monitor Report when something struck me.

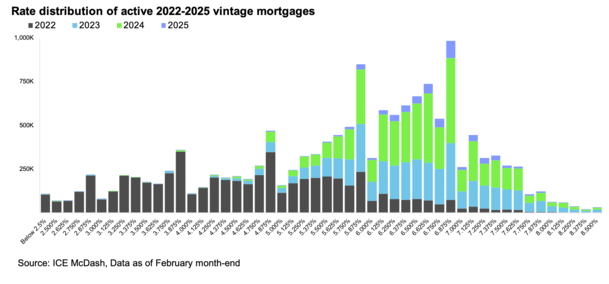

In their rate distribution chart of recent mortgages, I noticed a super wide range of rates during the year 2022.

This was because the 30-year fixed began the year around 3%, and ascended rapidly to around 7.5% by that October.

It has to be the worst year on record for mortgage rates going as far back as records go.

But something else popped out at me as well, which could be important if you’re shopping for a home loan.

2022 Became a Terrible Year for Mortgage Rates

As noted, 2022 was the worst year for mortgage rates on record in terms of movement.

While the rate itself was lower, only rising above 7%, the magnitude of change is unrivaled. Nearly a tripling in rates.

That’s nowhere close to the 18% mortgage rates in the 1980s, but the speed and intensity of change is second to none.

In 1981 the 30-year fixed began the year at around 14.9%, per Freddie Mac. It then climbed to 18.45% that October before quickly calming down again.

By 1982 it was back to the 13% range, where it stayed until 1985 as rates began their long descent to the single-digits.

So while a rate of 7.5% wasn’t notable, the rise in percentage terms was pretty bonkers. Going from 3% to 7.5% is a 150% change.

Conversely, going from 15% to 18% is just a 20% change. Sure, big numbers, but much smaller changes percentage-wise.

Anyway, that was the first reason I was studying this chart, pictured above. But not the reason I’m writing this post.

The Range in Rates During the Year Extended From the Mid-2s to the High-7s

What was even more crazy about 2022 was the range in rates offered to borrowers, as seen in the chart from ICE.

Some very lucky borrowers were able to snag sub-2.5% mortgage rates as late as 2022. So despite it being a terrible year eventually, many still made out really well.

Of course, they had to get those mortgages closed in the first few months of the year.

Basically by March rates were in the 4% range, and by April the 5% range. And by June, you guessed it, the 6% range.

The window was tight, but many still managed to get rates that started with a 2, 3, 4, and even a 5, which sounds not half-bad today.

It truly was a year like no other when it came to mortgage rates.

The fact that two borrowers could sit down and ask what rate they received, and one could say 2.5% and the other 7.5% tells you everything you need to know.

Be Careful Which Mortgage Rate You Choose

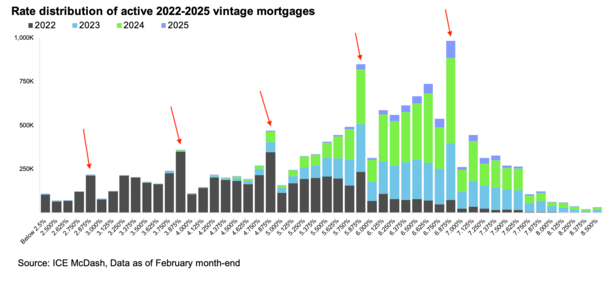

But here’s what’s most interesting about the chart. As I annotated above, look at the rates that have the most active mortgages across all the vintages (2022 to 2025).

It’s not the 3% rate, the 4% rate, or the 5% rate.

It’s the 2.875% rate, the 3.875% rate, the 4.875% rate, the 5.875% rate and the 6.875% rate.

And why do you think that is? Why is this seemingly random .875% rate appended to the most mortgages?

Well, mortgage rates are offered in eighths, so the final eighth available before you hit the dreaded next big number ends with .875%.

In other words, a borrower is more likely to be sold a rate of 6.875% rather than 7% because it just sounds (and looks) a lot better.

What would you rather have? A rate that starts with 6 or 7?

If you look at the chart, you can see that rates ending in .875% were the most common in all the vintages included.

For example, in 2024 most borrowers opted for a rate of 5.875% instead of 6%, or 6.875% instead of 7.

In 2023, it was the same two rates that were most popular amongst homeowners.

In 2022, they opted for 3.875% and 4.875% the most. And some got 2.875%.

While rates may have changed over the years, the .875% still reigned supreme.

How Much Are You Actually Savings If Anything at All?

Thing is, these sub-7% rates, or sub-6% rates may not be a great deal.

Let’s consider a $400,000 loan amount at 6.875% versus 7%. The difference in monthly payment is just $34.

Now imagine if you paid an extra $1,000 in closing costs to obtain that rate.

You compared lenders but didn’t pay attention much to the closing costs. Well, that $34 in savings will take about 30 months to recoup.

What happens if you sell the home or refinance the mortgage before then? You’d leave money on the table.

You wouldn’t realize the savings of the lower rate and it’d be merely a psychological victory having a rate that started with a number one digit lower.

The point I’m trying to make here is that opting for a rate just below a key threshold (whole number like 6%, 7%, etc.) might not be in your best interest, literally.

So when shopping mortgage rates, take the time to determine what combination of rate and closing costs makes the most sense based on how long you plan to keep the loan/property.

Sometimes it’s actually better to take the higher mortgage rate.

And don’t get lured by one lender, who may charge you more, simply to get a rate that appears a lot lower than it actually is. Take note of the difference in the monthly payment!

FYI, the same principle applies to rates that end in .99%, no different than when you buy food at the grocery store. But the difference is even smaller!

Read on: Watch Out for Low Mortgage Rates You Have to Pay For